The Exide Share Price has increasingly reflected the company’s pivot toward electric vehicle (EV) battery manufacturing—an area expected to drive the next wave of growth in India’s auto and energy sectors. As investors get more familiar with terms like SME IPO Means, they also become more discerning in spotting large-cap companies that are evolving with the times, just like Exide Industries.

The EV Shift: A Strategic Transformation

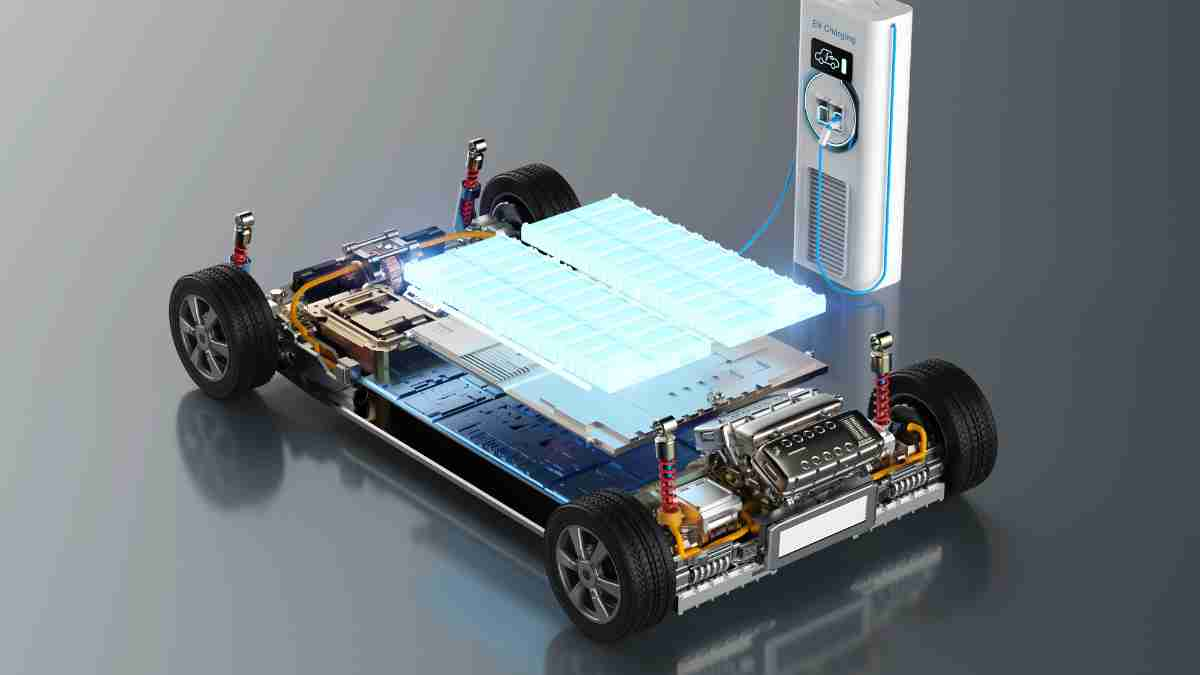

For decades, Exide Industries has been synonymous with lead-acid batteries, catering primarily to traditional automotive and industrial segments. But with the global and domestic shift toward cleaner transportation, the company is aggressively investing in lithium-ion battery technology to stay relevant.

- Gujarat Giga Factory Project: In a significant move, Exide is setting up a lithium-ion cell manufacturing facility in Gujarat. The plant, once operational, will have a multi-GWh capacity and make Exide a serious contender in India’s EV supply chain.

- Partnership with Leclanché: Through its joint venture “Nexcharge,” Exide has entered the lithium-ion battery pack segment, supplying energy storage systems and EV batteries for both commercial and passenger vehicles.

Share Price Implications

The market often responds positively to long-term strategic moves, even if they don’t translate into immediate profits. In Exide’s case, several developments in its EV journey have sparked optimism:

- Valuation Uplift Potential: Lithium-ion technology is typically associated with high-margin, high-growth potential. By moving into this space, Exide positions itself in a premium valuation bracket, which could gradually rerate the stock.

- Diversified Risk Profile: Investors appreciate the fact that while Exide modernizes, it still has a strong cash-generating lead-acid business to support expansion. This balance adds confidence and stability to the share price during volatile times.

- Investor Sentiment: News of capex in EV facilities, new OEM partnerships in the EV space, or government subsidies for cell manufacturing often act as short-term catalysts for the stock price.

Market Context: Why It Matters Now

India is one of the world’s fastest-growing EV markets. With government schemes like PLI (Production Linked Incentive) for Advanced Chemistry Cells and increasing demand for electric two-wheelers, the stage is set for battery suppliers to scale.

Exide’s early and calculated entry gives it a first-mover advantage over legacy competitors still contemplating EV battery strategies. This foresight may be crucial in determining long-term stock performance.

Challenges Ahead

While the future looks promising, execution will be key. The EV battery space is capital-intensive, technologically demanding, and competitive. Exide must prove its manufacturing capability, ensure supply chain stability, and align with evolving safety norms.

Conclusion

Exide’s push into EV batteries is a bold yet necessary transformation that could redefine its growth trajectory. For investors tracking the Exide Share Price, this evolution signals not just a business shift, but a strategic leap into the future of mobility. And much like learning what SME IPO Means helps in understanding new market entrants, following Exide’s EV journey helps decode the next chapter of India’s battery market.